Balancing act practice worksheet answers provide a comprehensive overview of the concepts and skills covered in the worksheet. These answers are designed to help students understand the key concepts and apply them to real-life situations.

The worksheet covers a range of topics, including budgeting, time management, and decision-making. The answers provide step-by-step instructions on how to complete each exercise, as well as helpful tips and strategies.

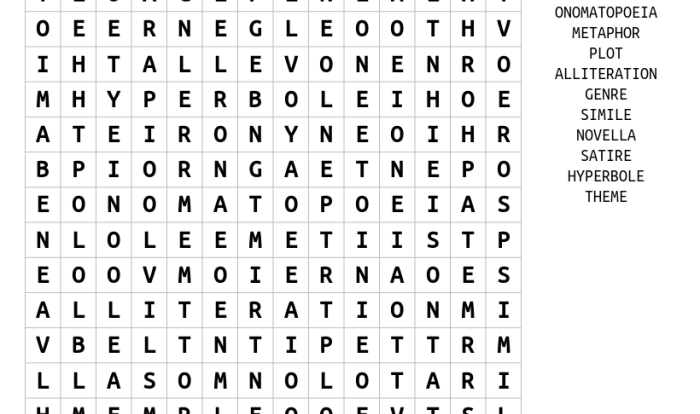

Balancing Act Practice Worksheet: Overview: Balancing Act Practice Worksheet Answers

The Balancing Act Practice Worksheet is a valuable tool designed to enhance financial literacy and develop essential budgeting skills. It provides a structured approach to understanding income, expenses, and financial goals, empowering individuals to make informed financial decisions.

The worksheet covers key concepts such as budgeting, cash flow management, debt repayment, and financial planning. By completing the exercises and activities in the worksheet, individuals can gain a comprehensive understanding of their financial situation and develop strategies to achieve their financial objectives.

Worksheet Structure and Content

The Balancing Act Practice Worksheet is organized into sections and subsections, each focusing on a specific aspect of financial management.

Income and Expenses

This section includes exercises that help individuals track their income and expenses. It encourages them to categorize their expenses into essential and non-essential categories, identify areas where they can reduce spending, and develop a realistic budget.

Debt Repayment, Balancing act practice worksheet answers

This section focuses on debt management. It provides guidance on calculating debt-to-income ratios, creating a debt repayment plan, and exploring debt consolidation options.

Financial Planning

This section covers long-term financial planning. It includes exercises on setting financial goals, creating a savings plan, and investing for the future.

Examples and Methods

The worksheet provides numerous examples and step-by-step methods to guide individuals through the exercises.

Example: Categorizing Expenses

The worksheet includes a table where individuals can list their expenses and categorize them as essential (e.g., housing, food, transportation) or non-essential (e.g., entertainment, dining out).

Method: Debt Repayment Plan

The worksheet provides a formula to calculate debt-to-income ratio and a template to create a debt repayment plan that prioritizes high-interest debts and sets realistic payment schedules.

Applications and Extensions

The skills learned from the Balancing Act Practice Worksheet can be applied to real-life situations to improve financial well-being.

Individuals can use the worksheet to:

- Create and maintain a realistic budget

- Manage debt effectively

- Plan for future financial goals

To enhance understanding, individuals can supplement the worksheet with additional activities, such as:

- Attending financial literacy workshops

- Consulting with a financial advisor

- Reading books or articles on personal finance

Helpful Answers

What is the purpose of the balancing act practice worksheet?

The purpose of the balancing act practice worksheet is to help students understand the concepts of budgeting, time management, and decision-making.

What are the benefits of using the balancing act practice worksheet?

The benefits of using the balancing act practice worksheet include improved understanding of the concepts of budgeting, time management, and decision-making, as well as the ability to apply these concepts to real-life situations.

How do I use the balancing act practice worksheet?

The balancing act practice worksheet can be used individually or in a group setting. Students should read the instructions carefully and complete each exercise in order.