What advantage does the 1031 tax-deferred exchange offer? This intriguing question unlocks a world of possibilities for investors seeking to optimize their real estate portfolios. By delving into the nuances of this powerful tax strategy, we uncover a multifaceted tool that empowers investors to defer capital gains taxes, upgrade properties, diversify investments, manage liquidity, and enhance estate planning.

Throughout this discourse, we will explore the intricacies of 1031 exchanges, unraveling their potential to transform investment strategies and maximize wealth accumulation.

1031 Tax-Deferred Exchange: Benefits and Advantages: What Advantage Does The 1031 Tax-deferred Exchange Offer

1031 tax-deferred exchanges are a powerful tool for real estate investors. They allow investors to defer capital gains taxes on the sale of investment property by reinvesting the proceeds in a similar property.

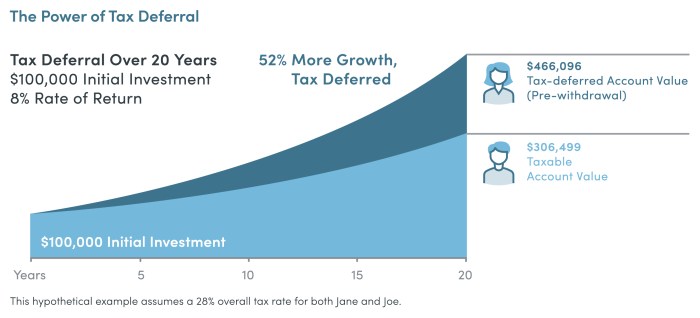

Tax Deferral Benefits

The primary benefit of a 1031 exchange is the ability to defer capital gains taxes. When an investor sells a property, they are subject to capital gains tax on the profit they make. However, if they reinvest the proceeds in a similar property within 180 days, they can defer the taxes until they sell the replacement property.

The time frame for deferring taxes is indefinite. Investors can continue to defer taxes as long as they keep reinvesting the proceeds in similar properties.

Property Upgrading Opportunities, What advantage does the 1031 tax-deferred exchange offer

1031 exchanges also provide investors with the opportunity to upgrade their properties without triggering immediate taxation. For example, an investor could sell a rental property and use the proceeds to purchase a larger or more valuable property. This allows investors to build their portfolio and increase their net worth over time.

Flexibility and Investment Diversification

1031 exchanges offer flexibility in investment strategies. Investors can use exchanges to diversify their portfolios by investing in different property types or locations. This can help reduce risk and improve overall investment returns.

Liquidity Management

1031 exchanges can also help investors manage liquidity. By deferring capital gains taxes, investors can postpone large tax payments and preserve cash flow. This can be especially beneficial for investors who are reinvesting in a more expensive property.

Estate Planning Considerations

1031 exchanges can also be used for estate planning purposes. By deferring capital gains taxes, investors can reduce the value of their estate and potentially reduce estate taxes.

FAQ Corner

What is the time frame for deferring taxes under a 1031 exchange?

Taxes are deferred indefinitely as long as the proceeds from the sale of the relinquished property are reinvested in a qualifying replacement property within the specified time frames.

Can 1031 exchanges be used to acquire multiple replacement properties?

Yes, investors can acquire multiple replacement properties as long as the total value of the replacement properties is equal to or greater than the value of the relinquished property.

What are the potential drawbacks of 1031 exchanges?

Potential drawbacks include transaction costs, the need to identify and acquire suitable replacement properties within tight time frames, and the potential for depreciation recapture if the replacement property is sold at a gain.